Let me say this upfront, one of the fastest ways to lose your company in South Africa is not fraud, not debt, not competition it is simply forgetting to file your CIPC annual return. Yes, something that can cost as little as a few hundred rand can shut down a company you spent years building, and the worst part? Most entrepreneurs don’t even realize they have missed it until their bank account is frozen or their company status shows “Deregistered.”

So what exactly is a CIPC annual return? In simple terms, it’s the Companies and Intellectual Property Commission asking one basic question, “Is your company still operating?” Every registered company in South Africa must confirm this once a year. You’re not re-registering your business, and you’re not necessarily changing directors or details. You’re simply confirming that the company still exists and is active. If you don’t confirm it, CIPC assumes the company is inactive and begins the deregistration process, that’s where the trouble starts.

You must file your annual return every year on your company’s registration anniversary date. For example, if your company was registered on 15 June 2022, your annual return is due every year on 15 June. CIPC gives you 30 business days from that anniversary date to file. If you miss that window, penalties start accumulating, If you miss it for two consecutive years, your company can move into deregistration. Leave it longer, and it can be fully deregistered meaning legally your company no longer exists.

Many entrepreneurs think annual returns don’t matter if the company is dormant or not trading, that assumption is expensive. Even if your business made zero income, you must still file, if you don’t your status changes to “AR Overdue,” then to “In Deregistration,” and eventually to “Deregistered.” Once deregistered your business bank account may be frozen, you can’t apply for funding or tenders, you lose access to tax clearance, and in some situations, directors may face personal exposure. All because of one missed filing.

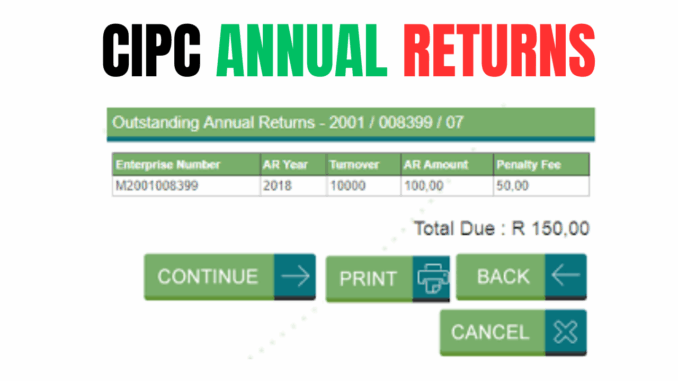

The cost of filing is relatively small and depends on your turnover. For many small companies, it ranges between roughly R100 and R450, sometimes slightly more for higher turnover, compared to the stress and cost of reinstating a deregistered company including penalties, it is minimal. Ignoring annual returns to “save money” often results in much bigger expenses later.

Filing is done online through the CIPC eservices platform. You log in with your customer code, select “File Annual Returns,” enter your company registration number and confirm your turnover, the system calculates the fee. You must also ensure your Beneficial Ownership (BO) information is up to date, as this is now a mandatory requirement. If BO is not submitted correctly your annual return won’t process. After payment, you can download the confirmation (CoR30.1) and keep it safely in your compliance records. Your status will then reflect “In Business.”

If your company is already deregistered don’t panic, reinstatement is often possible especially if deregistration was due to non-filing of annual returns. However, you will need to file all outstanding returns, pay accumulated penalties, and ensure Beneficial Ownership information is correct. The process can move quickly if handled properly but delays make it more complicated.

The organized way to handle annual returns is simple, store your registration anniversary date in your calendar, set reminders well in advance, keep your turnover figures updated, and maintain secure access to your CIPC login details. File even if the company is dormant, small systems prevent large emergencies.

Many entrepreneurs only take compliance seriously when something goes wrong when the bank freezes the account, when a tender is rejected, or when investors walk away. Annual returns are one of those small administrative tasks that quietly protect your business in the background, you don’t notice their value until they’re missing.

If you are serious about building something long-term in South Africa you cannot ignore annual returns, they are basic, affordable, and powerful. Compliance is not about paperwork for the sake of paperwork it’s about protecting what you’re building. An organized entrepreneur doesn’t wait for emergencies, they handle small obligations before they become big problems. So check your company status if it says “AR Overdue,” fix it. If it says “In Deregistration,” act quickly and if it says “Deregistered,” don’t delay. Structure protects growth and growth is the goal.

Leave a Reply